US Monthly Used Car Market Data – March 2025

The US used car market remains full of insights and opportunities for those looking to stay ahead of the curve. It’s a fast-moving space shaped by a range of factors, especially regional differences and local demographics. In this report, we take a closer look at dealership activity, sold vehicle trends, and pricing data across different states. We also break down key market indicators, including price bands, auction trends, and other core metrics that help paint a clearer picture of the current landscape.

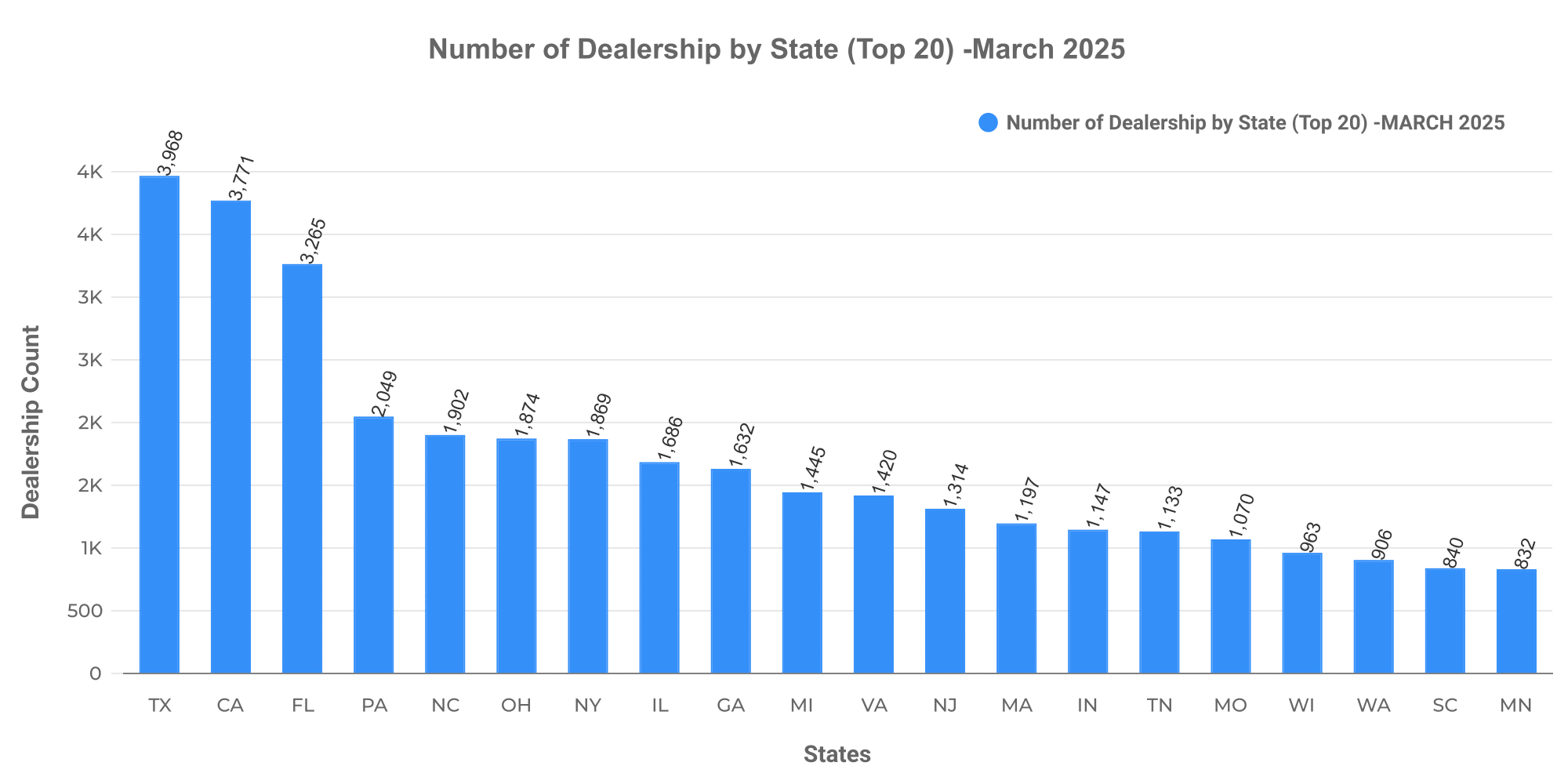

Number of Dealerships by State

Diving into the March 2025 data, an interesting dynamic comes to light when comparing the number of dealerships across states. Texas sat at the summit with 3,968 used car dealerships, followed by California with 3,771, while Florida housed 3,265 dealerships. On the lower tier, District of Columbia, Guam, and American Samoa had the minimum dealership count, with 3, 8, and 1 respectively.

The evident disparity emphasizes the extensive opportunities available in states with lower dealership numbers. Firms and small businesses considering expanding their footprint in the used car market may find these states an lucrative prospect for operations expansion or even starting new franchises.

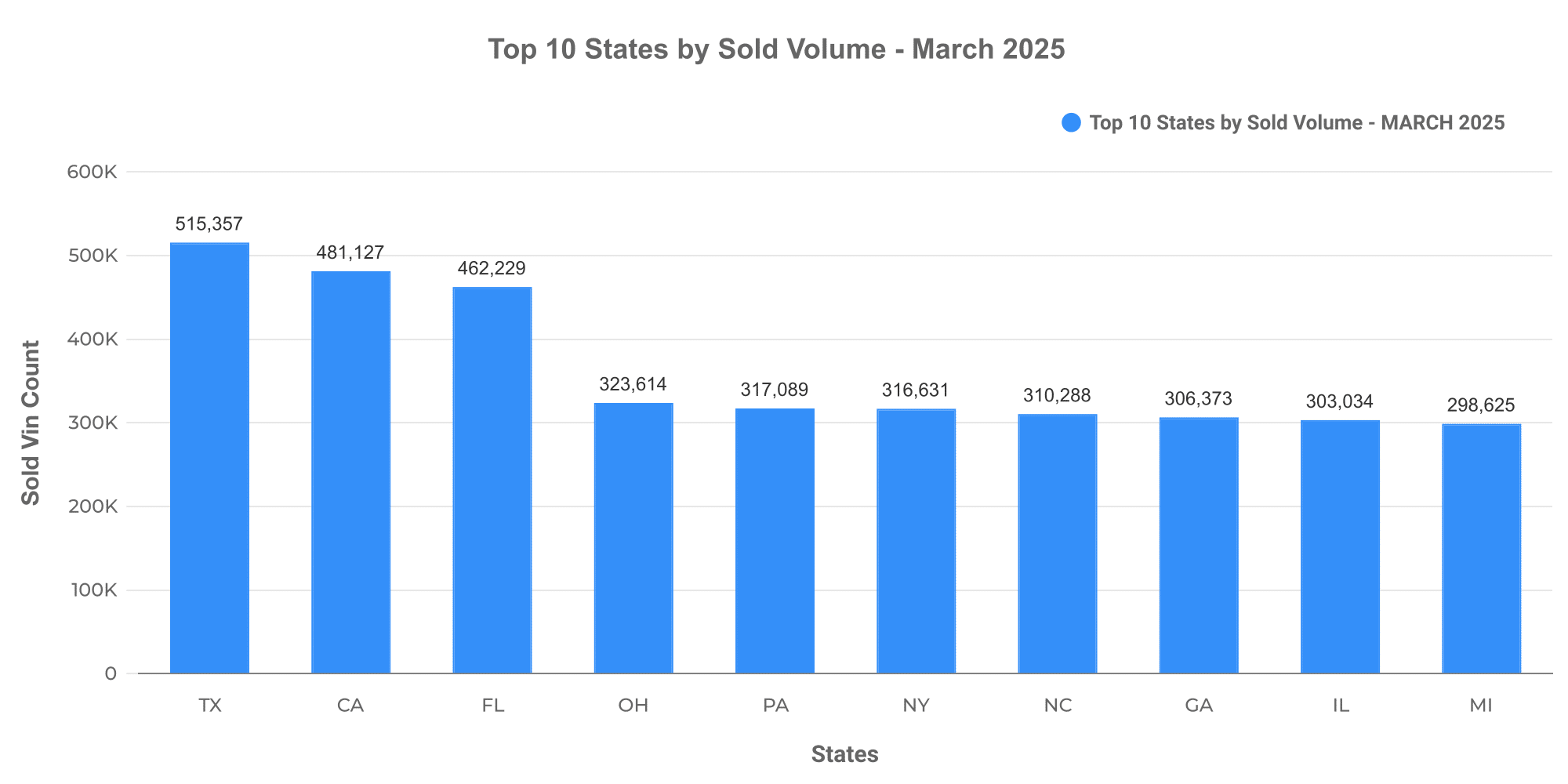

Top 10 States by Sold Volume

An exploration of car sales trends reveals California, Texas, and Florida as the leading states in terms of sold volume for March 2025.

California managed to sell 481,127 used vehicles, Texas followed with 515,357, while the Sunshine state, Florida, rounded out the top three with 462,229 vehicles. These three states collectively accounted for a significant share of the total monthly sales.

The remaining seven states among the top ten – Ohio, Pennsylvania, New York, North Carolina, Georgia, Illinois, and Michigan – also demonstrated impressive sales volumes, contributing to a robust used car market in the US.

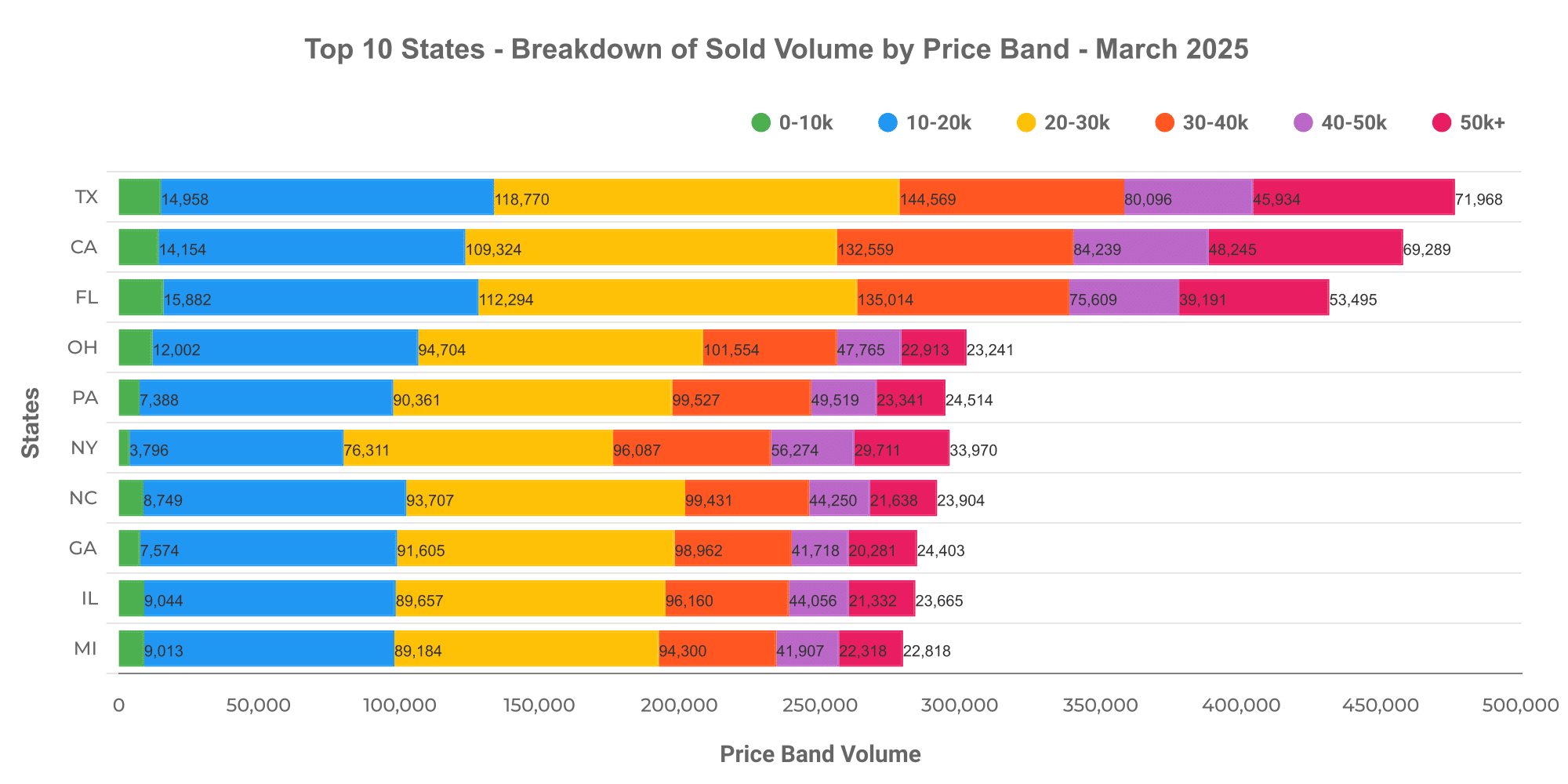

Price Breakdown: Top 10 States by Sold Volume

The diversity in price bands offers a rich tapestry of insights for dealerships, insurance companies, car finance lenders, brokers, and investment firms in the US automotive sector.

Taking a closer look at the top state, California exhibited an array of price bands. Most sold vehicles were priced between $20,000 to $40,000, making up 48% of the total sales. The $10,000 to $20,000 range followed with 30%, while 15% of sold vehicles were marked above $40,000. The below $10,000 segment accounted for just 7%.

Just as with California, the other states in the top 10 showed varying distributions within their respective price bands, showing strong potential for optimizing pricing strategies to maximize profits.

Comparison: High-Volume vs Low-Volume States

A comparison of high-volume and low-volume states offers critical insights that could influence business strategies. The high-volume states indicate higher demand for used cars, but also higher competition among dealerships. Conversely, the low-volume states might reflect either low demand or unexploited market potential.

Studies reveal that vehicle prices tend to be higher in low-volume states, possibly due to a lack of competition. On the other hand, high-volume states witness a diverse price band distribution, highlighting the criticality of correct price point positioning.

Identifying, analyzing, and responding to these dynamics is one way Marketcheck can provide nuanced insights to identify potential growth areas and optimize strategies.

Rely on Marketcheck to access thorough, evidence-based data on US used car market trends via feeds, APIs, spreadsheets, and analysis tools. MarketCheck’s comprehensive data sets provide valuable insights into every current and historical used car advert listing in the US. As a critical stakeholder in the ever-evolving US auto industry, Marketcheck is your partner in making informed, strategic decisions.